What is Shop Pay Installments/Affirm and why does it break accounting? If you are selling on Shopify, there’s a good chance that you are seeing deposits in your bank account from “shoppayinst afrm” in your bank account. Even if you are using an ecommerce integration software like A2X, you won’t find a match for this deposit transaction in your accounting system. So what do you do? In this article I’ll explain why are you are seeing those deposits and how to account for them properly.

First, verify why you are seeing these deposit. Go to Shopify settings and look eat Payments. You’ll see if the purple Shop icon as show below is present, then you have Shop Pay turned on.

If you have verified that you have Shop Pay Installments turned on, it will explain why you see deposits in your checking account labeled “shoppayinst afrm”. Below is an example of how this deposit looks in QuickBooks Online.

Since you have this payment option for customers, it means that you are allowing them to pay for your product over time. Shopify has partnered with Affirm to make this happen. This can be a great option if you sell a high priced product, but probably not something you want to offer for products less than $100 due to the fees. The fees are higher than regular payments – Shop Pay Installments fees are 5.9% + $0.30 per transaction. More than double regular Shopify Payments fees.

How do you code these transactions in your accounting system?

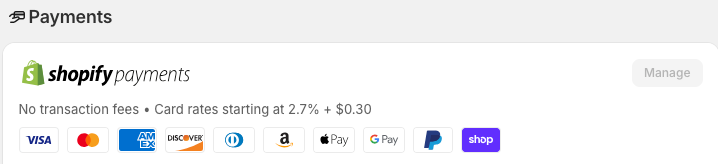

Now that you have verified why you have these deposits coming in to the bank account, you’ll need to set up some accounts to handle the accounting. You’ll need one account for the accumulation of these deposits and one account for the fees. The account for accumulation of deposits will be a current asset account and the fee account will be an expense account. Below is an example of how I have set up these accounts in QBO.

All deposits into your account from Shop Pay Installments should be coded to the Shopify Installments/Affirm Clearing account. You will not see the fees or the sales on these transactions hit your account. These transactions must be recorded manually or using an integration software like A2X.

How do I record Shop Pay Installment fees in QuickBooks?

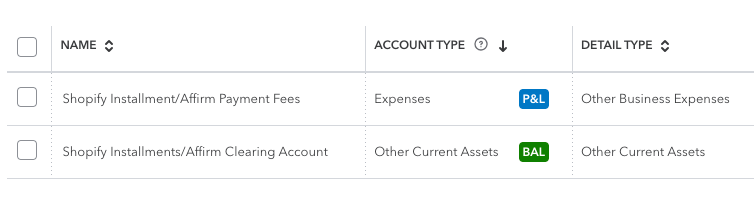

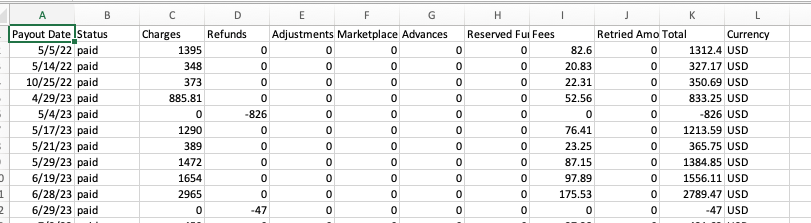

To record the fees, you’ll go to your Shopify account Finance > Payouts. Then Add filter > Payment Provider.

Export the file to Excel or Google Sheets and you’ll see a column for Fees. Sum total the fees for the month you are accounting for and make a Journal entry. Debit Shopify Installment/Affirm Payment Fees and Credit Shopify Installments/Affirm Clearing Account.

As of the time I am writing this, A2X is starting to handle this process automatically, so you won’t have to do this manual process if you are using A2X.

Last Step in Shopify Installments Accounting

Now you will have only transactions in QBO that reduce the Shopify Installments/Affirm Clearing Account. If you looked at the balance sheet, it should be a negative current asset balance. The missing piece is the sales data. Now that part is not something I recommend handling manually. You should use an integration software like A2X. If you map the transactions properly in A2X, the will go directly to the clearing account creating a positive amount. The mapping for A2X is show below.

The screenshot from QBO shown below shows the total sales from Shopify Installments of $490.45, total fees of $29.53, and all the deposits that came in reducing the balance sheet account to $0. If you are starting the books at some point in time say 1/1/2025, you’ll need to record any opening balance. In the case below, the opening balance $78.89 and the payment that came in to clear that amount from December was on 1/1/2025. Due to this day or two overlap, the balance sheet account may not always zero out each month. This is especially true for higher volume accounts than this one.

Shopify Installment accounting is not straight forward and you need document process to follow each month to ensure you are properly recognizing these high fees and not duplicate sales by recording these deposits as revenue. If you are tired of struggling with complex Shopify Bookkeeping, book a call with me and learn more about how you can get clean monthly accounting done for you by a qualified Shopify bookkeeper.