Blogs

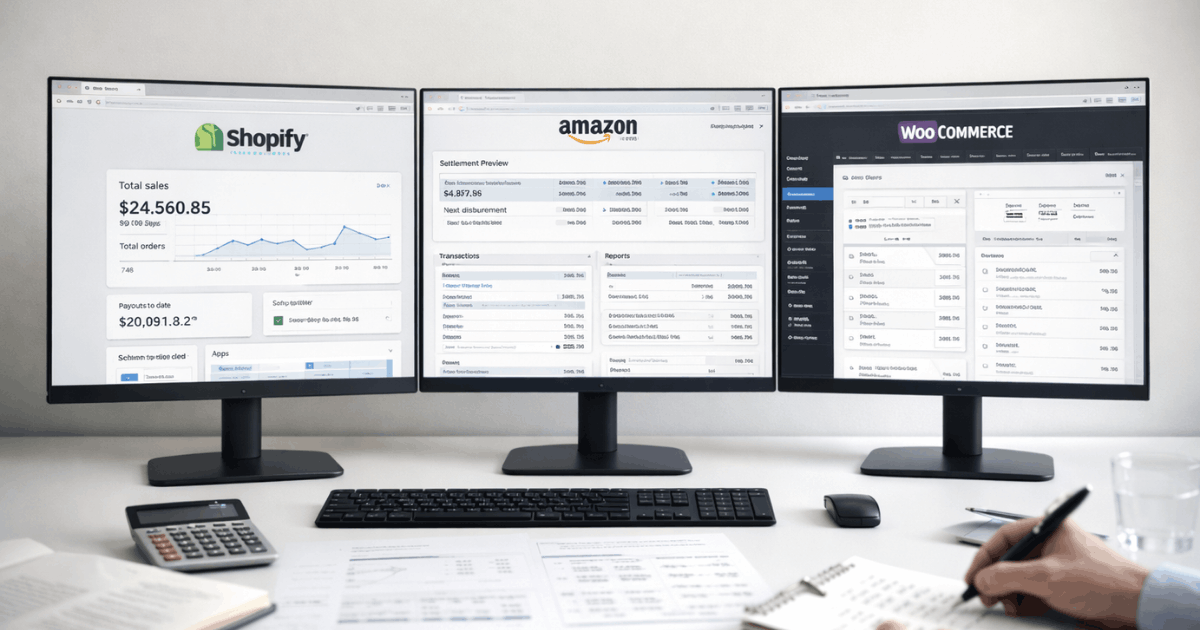

Which E-Commerce Platform Has the Best Resources for Accounting?

Choosing an ecommerce platform is not just an operational decision. It is a financial one. As your business grows, the platform you sell on directly

What Are Important Accounting Practices for Online Retailers Scaling to 7 Figures?

As online retailers scale toward seven figures, accounting stops being a background task and becomes a critical growth function. At lower revenue levels, basic tracking

How Can Accounting Help Maximize My E-Commerce Profits?

Every ecommerce seller wants to grow profits, but few realize how much of that growth depends on accounting. It is not just about tracking income

Capital Raising Services for Ecommerce Businesses: What to Expect

As ecommerce businesses scale, access to capital becomes one of the biggest growth hurdles. Expanding into new marketplaces, increasing inventory, or investing in technology all

Raising Capital: How Ecommerce Accountants Prepare Businesses for Funding

Raising capital for your ecommerce business takes more than ambition and strong sales. Investors and lenders look beyond your products; they want evidence that your

Raising Capital for Business: Why 7-Figure Ecommerce Sellers Need Clean Books

When your ecommerce business starts scaling past seven figures, growth can stall for one simple reason: lack of capital. Whether you’re expanding inventory, entering new

Ecommerce Set Up Bookkeeping: Getting It Right From Day One

If you’re running or launching an ecommerce business, getting your bookkeeping right from day one is one of the smartest moves you can make. Most

How To Do Bookkeeping For Amazon Sellers Without Losing Control

If your Amazon business has started generating consistent revenue, you’ve likely realised that bookkeeping isn’t just about data entry, it’s about visibility. You can’t manage

Ecommerce Bookkeeping Software: Tools Every 7-Figure Seller Should Know

Running a high-revenue ecommerce business isn’t just about selling products. As your revenue scales, so do the complexities of managing multiple sales channels, reconciling marketplace

Bookkeeping for Shopify: Specialized Support for High-Revenue Stores

When your Shopify store starts generating seven figures, “basic bookkeeping” no longer cuts it. The mix of payouts, refunds, fees, discounts, and multi-channel integrations introduces

Bookkeeping for Online Business: Why 7-Figure Sellers Can’t Afford Generalists

Bookkeeping for an online business is far from one-size-fits-all, especially for sellers hitting seven figures in revenue. As your ecommerce venture grows, the complexity of

Bookkeeping for Ecommerce: The Key to Tax Compliance and Stress-Free Scaling

Every successful ecommerce business knows that behind every smooth operation lies well-organized financial records. Bookkeeping is the foundation that supports your ability to stay tax