1. Waiting Until March to Worry About Your Bookkeeping for Last Year

It’s tax time so I should start looking for a CPA to prepare my taxes right? Wrong. The fact is that a CPA can prepare your taxes at that point, but if you haven’t kept up with your books for the prior year, it could cost you a lot more. The typically price of preparing a tax return does not include recreating a set of books for the prior year. Depending on the information you have (or lack thereof) it could take hours of additional work for your CPA to recreate a set of books to prepare a tax return.

Recreating months’ worth of bookkeeping long after those months have passed can be difficult and possibly inaccurate due to omissions or lack of recollection of what certain transactions were. If you haven’t been keeping up with your bookkeeping for the prior year and you can’t hand over an accurate profit and loss or balance sheet to your CPA, you’ll probably incur additional costs for them to recreate your books for the prior year.

2. Not Knowing if Your Business is Profitable

I know this seems so basic, but I’ve learned over the years that there are many business owners who do not have an accurate picture of their profit or loss. The sad fact is that a lot of small business are not profitable and the owners continue to feed them with equity or even worse, debt, and the situation never gets any better.

At a minimum, you should know whether your business is running at a profit month over month and year over year. Additionally, you should have an accurate item level profitability analysis. Even if your business is profitable overall, there may be products that are selling at a loss or just a lower than acceptable ROI that can be dragging down your overall profitability.

3. Not Paying Back Short-term Debt as Your Inventory Turns

Many Amazon sellers use short-term debt such as credit cards or Amazon Capital loans to finance their inventory. I’m not a big fan of debt, due to the risks it presents for your business, but it can be managed and allow you to expand your business beyond what you could do with equity alone. When you use short-term debt, you should be paying back the portion of each settlement you receive attributable to the inventory financed.

That means if your inventory is 100% financed with credit cards and your cost of goods sold is 30%, then 30% of every single settlement you get should immediately be used to pay down the debt. If not, that money could be used for other expenses or be distributed out of the business. This could result in a situation where your short-term financing exceeds the value of your inventory and cash, putting you in a situation called “negative working capital”.

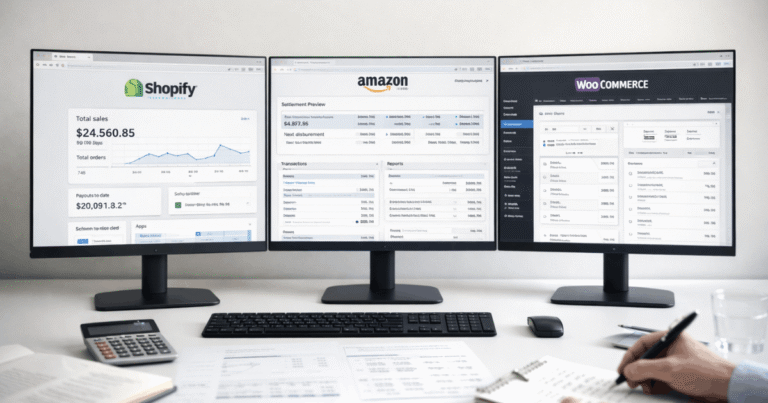

4. Not Setting Up a “Complete” Accounting System

There are so many tools available to help Amazon Sellers track profitability of the items that they sell such as InventoryLab, GoDaddy Bookkeeping, or SellerBoard. The problem with many of these solutions is that they really are not complete. They tend to focus on the income, expenses, and COGS as it relates to your Amazon transactions, but not much more than that. Essentially they give you your gross margin, but don’t do well accounting for other operating expenses.

We all know that we have business expenses outside of these such as purchases of supplies, equipment, payment for contract labor, interest on debts, etc. If you don’t have a system that is automatically pulling all these transactions into your accounting system, then it is very possible that you are not accounting for certain expenses.

This has two main consequences; 1) you think you are more profitable than you are and 2) you are paying more in income taxes than you should. Nevertheless, these tools give you very good information and I do recommend using them in conjunction with a complete accounting system such as Quickbooks Online.

5. Not setting up an automated bookkeeping system

Luckily for Amazon Sellers these days there are so many tools available that help you create an almost a completely automated accounting system. If you are spending time each month entering anything manually, you are doing it wrong.

Accounting systems available today have automatic bank transaction feeds, rule sets that can be applied to automatically classify and book transactions and apps that integrate separate systems to automate importing of transactions. One such system that does all these things is Quickbooks Online. With Quickbooks Online you will have access to your books from anywhere you have a data connection through the mobile app.

If you are making any of these mistakes or are not happy with your current bookkeeping systems, now is the time to take action. The longer you wait, the harder it is to accurately recreate what has happened in the past.

Reach out to The Seller CPA today to get started with a firm grasp on your business financials.