8/5/2021 update: Amazon collects sales tax on your Amazon sales and remits the tax to the state for you in all states that require sales tax except for Missouri. Missouri has now passed a law that requires Amazon to collect for that state by 2023. Prior to 2023, Missouri does not have legislation that requires remote sellers that sell products into Missouri to collect sales tax.

Do you need to collect sales tax as an Amazon Seller? It depends on 2 factors: 1) the state you operate your business in and 2) whether or not you sell on other platforms.

Amazon-only Sellers

First I’ll address selling on Amazon only. More and more states are moving towards making Amazon collect sales tax for you, so you may not have to do it on your own. My opinion is that eventually all states will require Amazon to collect sales tax and that will be the norm. The trend is moving in this direction. Here is a list of states that Amazon is facilitating collection of sales tax for: https://www.amazon.com/gp/help/customer/display.html?nodeId=202211260

If you operate in a state that doesn’t require Amazon to collect sales tax, I recommend that you register in your own state and set up collection of sales tax in your home state. If you only sell on Amazon and they facilitate collection of sales tax in your home state, you don’t need to register because you won’t be collecting any sales tax and you won’t need to file a sales tax return. There are 2 exceptions. One exception to this is if you purchase from a distributor that requires a reseller certificate. In that case you’ll need to register with your home state to get a valid reseller certificate. In this case you’ll file returns with zero sales since Amazon facilitated the collection of tax for you. The 2nd exception is if your state requires that you file a reseller certificate for some other reason like simply having a physical presence. Check with your specific state requirements here: https://www.salestaxinstitute.com/resources/remote-seller-nexus-chart

Multi-Channel Sellers

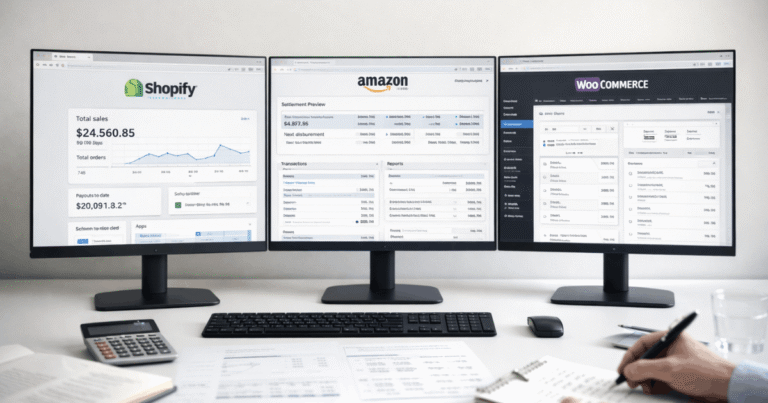

If you sell on other platforms such as Shopify, eBay, Walmart and those platforms are not facilitating sales tax collection, you may need to collect. The good news is that each state has its own sales thresholds for determining whether you need to collect sales tax for them. Some of the thresholds are pretty high and that’s great news.

In order to determine your exposure to collection of sales tax, you’ll need to review your sales on a state by state basis. You can get this info from Seller Central. Here is an excellent resource by The Sales Tax Institute that outlines state by state thresholds: https://www.salestaxinstitute.com/resources/remote-seller-nexus-chart

If you are below the threshold of sales, you don’t need to worry about it.

Automate Your Sales Tax Reporting

Once you’ve determined your exposure to the sales tax requirements, I recommend that you use a sales tax automation software to calculate what you owe and help you file. This is something that you absolutely shouldn’t try to do manually. It just doesn’t make sense because it’s too complicated and there are many automation software providers that don’t cost very much at all. I don’t do sales tax return preparation because I couldn’t possibly understand the rules of all 50 states and quite frankly, the automated software will be more accurate and efficient.

Generally speaking, only high volume sellers that are operating on multiple sales channels have to worry about collecting and remitting sales tax.