As online retailers scale toward seven figures, accounting stops being a background task and becomes a critical growth function. At lower revenue levels, basic tracking may feel sufficient. As transaction volume increases, however, poor accounting practices can hide margin issues, create tax exposure, and slow decision making.

If you are asking what are important accounting practices for online retailers, the answer lies in structure, consistency, and accuracy. Strong accounting practices give you visibility into true profitability, help you stay compliant, and allow your business to scale without financial blind spots.

Why Accounting Practices Matter More as Online Retailers Scale

Growth introduces complexity. More products, more platforms, more fees, and more inventory movement all increase the risk of errors. Without disciplined systems, financial data becomes unreliable very quickly.

Implementing good accounting practices early ensures that your numbers remain accurate and actionable as volume increases.

The Difference Between Small Seller Accounting and Scaled Retail Accounting

Small sellers often rely on cash based tracking or basic summaries. At seven figures, that approach fails to capture timing differences, inventory costs, and true margins.

How Poor Accounting Slows Growth Decisions

When reports are delayed or inaccurate, decisions around pricing, advertising, and inventory are based on assumptions instead of data.

Why Financial Clarity Becomes a Competitive Advantage

Retailers with clean, consistent accounting can respond faster to demand changes and margin shifts than competitors with disorganized books.

Establishing Strong Accounting Principles and Procedures

Clear accounting principles and procedures create consistency across your entire operation. They ensure transactions are recorded the same way every month, regardless of sales volume or platform changes.

These foundations support reliable reporting and audit readiness.

Choosing Accrual Accounting Over Cash Accounting

Accrual accounting records revenue when earned and expenses when incurred. For online retailers, this provides a far more accurate picture of profitability than cash accounting.

Defining Clear Revenue Recognition Rules

Revenue should be recorded based on actual sales activity, not deposits. This avoids overstating income and ensures financial statements reflect reality.

Creating Written Accounting Procedures

Documented accounting principles and procedures protect consistency if staff, bookkeepers, or systems change.

Building a Chart of Accounts That Supports Growth

Your chart of accounts determines how clearly you can analyze performance. As your business grows, this structure must support deeper insight, not just basic totals.

A well designed chart of accounts is a core element of accounting best practices.

Separating Revenue, Fees, and Refunds Clearly

Gross sales, platform fees, and refunds should always be tracked separately to preserve visibility into actual performance.

Organizing Cost of Goods Sold Accurately

Inventory purchases, shipping, and fulfillment costs should flow through cost of goods sold so gross margins remain meaningful.

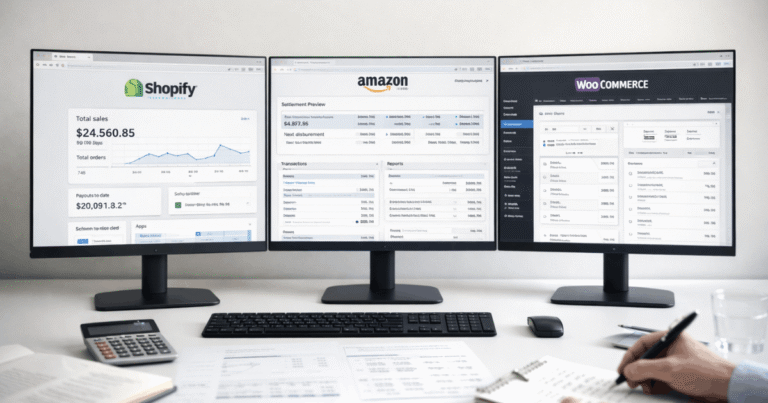

Designing Accounts for Multi Channel Selling

If you sell across multiple platforms, your accounts should support channel level analysis without unnecessary complexity.

Monthly Reconciliation as a Core Accounting Best Practice

Reconciliation is one of the most critical accounting disciplines for online retailers. It confirms that your reported numbers match real world activity.

Without regular reconciliation, small issues compound into major distortions.

Reconciling Bank Accounts and Payment Processors

Bank balances and payment processors must match your accounting records every month to confirm completeness.

Reconciling Sales Platforms to Accounting Software

Marketplace reports should align with recorded revenue, fees, and refunds to ensure accuracy across systems.

Why Monthly Reviews Prevent Year End Surprises

Monthly reconciliation catches errors early and avoids costly cleanups later.

Inventory Accounting Practices That Protect Profit Margins

Inventory is often the largest asset on an online retailer’s balance sheet. Poor inventory accounting can distort profits without obvious warning signs.

Strong inventory tracking is one of the most overlooked good accounting practices.

Tracking Inventory Movement in Real Time

Purchases, sales, and returns must be recorded consistently to prevent inflated assets or understated costs.

Matching Inventory Costs to Sales

Cost of goods sold should align with the period in which products are sold to reflect true margins.

Avoiding Margin Distortion From Inventory Errors

Incorrect inventory values can temporarily inflate profits and lead to poor pricing or expansion decisions.

Expense Management and Categorization Discipline

As revenue grows, expenses grow with it. Without discipline, costs can quietly erode margins.

Consistent expense tracking is a cornerstone of accounting best practices for online retailers.

Categorizing Expenses Consistently

Expenses should always be categorized the same way to allow accurate trend analysis.

Separating Operating Costs From Growth Investments

Advertising, software, and fulfillment costs should be tracked separately to measure return on investment.

Monitoring Fixed Versus Variable Expenses

Understanding which costs scale with revenue improves forecasting and pricing decisions.

Sales Tax and Compliance as a Core Accounting Responsibility

As online retailers scale, tax exposure increases. Sales tax compliance becomes more complex and more visible.

Strong accounting systems reduce compliance risk and protect the business.

Tracking Sales Tax Collected and Remitted

Sales tax collected should never be treated as revenue. It must be tracked separately and reconciled regularly.

Understanding Nexus and Reporting Obligations

Economic nexus rules vary by state. Accurate accounting supports correct filings and avoids penalties.

Preparing Books for Tax Review and Filing

Working with an experienced ecommerce tax accountant helps ensure records are clean and filings are accurate.

Financial Reporting Practices That Support Better Decisions

Accounting delivers its real value through reporting. Clear reports turn raw data into insight.

Online retailers benefit from consistent, structured reviews.

Reviewing Profit and Loss Statements Monthly

Monthly P and L reviews reveal margin trends and cost issues early.

Using Balance Sheets to Monitor Business Position

Balance sheets show inventory levels, liabilities, and cash position. Ignoring them creates blind spots.

Comparing Performance Across Periods

Trend analysis highlights what is improving and what needs attention.

Internal Controls That Reduce Errors and Risk

As volume increases, internal controls become essential. They protect accuracy and reduce operational risk.

Strong controls are part of sound accounting principles and procedures.

Separating Duties Where Possible

No single person should control every step of the accounting process.

Reviewing Reports Before Finalizing

A second review often catches issues before they become costly.

Maintaining Documentation for Key Transactions

Receipts and reports should be stored securely and remain accessible for review.

When Online Retailers Outgrow DIY Accounting

Many retailers start with do it yourself accounting. As complexity increases, this approach often becomes a bottleneck.

Knowing when to upgrade support is a critical scaling decision.

Signs Your Accounting Is Holding You Back

Unclear margins, delayed reports, or uncertainty around cash flow signal deeper issues.

The Cost of Fixing Accounting Mistakes Late

Cleanup work costs far more than building the right systems early.

How Professional Accounting Improves Focus and Control

Partnering with an ecommerce accounting firm allows business owners to focus on growth while maintaining financial clarity.

Building Accounting Practices That Scale With Your Business

The best accounting systems evolve alongside your business. They adapt to higher volume, more platforms, and regulatory changes.

Strong foundations make scaling smoother and more predictable.

Designing Systems for Future Growth

Accounting systems should anticipate growth rather than react to it.

Using Data to Guide Strategic Planning

Reliable accounting data supports forecasting, budgeting, and expansion decisions.

Maintaining Consistency Through Change

Consistency ensures clarity even during rapid growth periods.

Take Control of Your Accounting Before Growth Creates Risk

Scaling to seven figures is an opportunity, but it exposes weaknesses. Strong accounting practices protect profit, compliance, and decision making.

Working with an experienced ecommerce CPA helps ensure your systems support growth rather than slow it down.

Start With a Free QuickBooks Review

A Free QuickBooks Review identifies gaps in reconciliation, reporting, and overall accounting setup.

Use the Free Ecommerce Bookkeeping Self Review

The Free Ecommerce Bookkeeping Self-Review provides a quick assessment of whether your accounting practices are supporting or limiting growth.

For ongoing structure and oversight, many retailers rely on Monthly Accounting Plans to keep books accurate and investor ready year round.

FAQ

What are important accounting practices for online retailers?

Accrual accounting, monthly reconciliation, accurate inventory tracking, and consistent expense categorization are essential.

Why do accounting best practices matter more at seven figures?

Higher volume increases complexity. Without structure, errors multiply and profits become harder to measure.

How often should online retailers review financial reports?

Monthly reviews are critical for identifying trends and catching issues early.

What accounting principles and procedures should be documented?

Revenue recognition, expense categorization, reconciliation workflows, and inventory tracking should all be documented.

Can strong accounting practices improve profitability?

Yes. Clear accounting reveals where money is earned and lost, enabling better pricing and cost control.